Hello friends,

Welcome back with another topic, today we are going to discuss about MSME.

In this article we will discuss about : -

- What is meant by MSME ?

- What is the limit for MSME ?

- What is the benefit of MSME Registration ?

- Who Can Apply for MSME ?

- Documents Required for MSME Registration ?

Now, I am going to explain each topic ony-by-one

What is meant by MSME ?

MSME stands for Micro, Small, and Medium Enterprises. In accordance with the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the enterprises are classified into two divisions. The First is : -

Manufacturing enterprises – engaged in the manufacturing or production of goods in any industry.

and the second is : -

Service enterprises – engaged in providing or rendering services.

What is the Limit for MSME ?

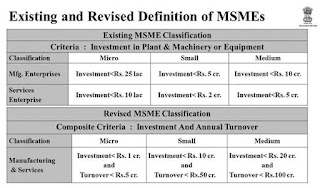

here we discuss Revised Limit for MSME however here i am attaching photo of Existing & Revised :-

For Manufacturing Enterprises & Services (Revised) : -

- Micro Enterprises : - Investment in Plant & Machinery or Equipment should be less than Rs. 1 Crore and Turnover less than Rs. 5 Crore.

- Small Enterprises : - Investment in Plant & Machinery or Equipment should be less than Rs. 10 Crore and Turnover less than Rs. 50 Crore.

- Medium Enterprises : - Investment in Plant & Machinery or Equipment should be less than Rs. 20 Crore and Turnover less than Rs. 100 Crore.

What is the Benefit of MSME Registration ?

Registration of an MSME is not legally mandatory but registering it will help you reap several benefits from the government including credit at low interest rate, incentives on products for exports, excise exemption, statutory aid such as reservations, and the interest on the payments delayed due to unavoidable circumstances. Even now msme registration known as udyog aadhar registration from the 2015.

The benefits offered to MSME enterprises are based on the classification of Micro, Small and Medium sized enterprises.

Who can Apply for MSME ?

MSME registration or Udyog Aadhaar can be obtained by any type of business entity. Proprietorships, Hindu Undivided Family, Partnership Firm, One Person Company, Limited Liability Partnership, Private Limited Company, Limited Company, Producer Company, any association of persons, co-operative societies or any other undertaking can obtain MSME registration in India. Small businesses having MSME registration enjoy various benefits under the Micro, Small and Medium Enterprises Development Act, 2006. Hence, it is recommended that all small businesses obtain MSME registration or Udyog Aadhaar after starting up.

Documents / Details Required for MSME Registration

- Aadhar Card (If Sole Proprietor) (Mobile No must be linked with Aadhar)

- PAN Card

- Business Address Proof

- Copies of Sale Bill & Purchase Bill

- Partnership Deed / MOA and AOA

- Copy of Licenses and Bill of machinery Purchased.

- Bank Details (Like : IFSC Code, Account No.)

- Investment in Plant & Machinery

- No. of Labour

At last here i am attaching Sample certificate of MSME

If you like this Article, Please Like this post and subscribe my youtube channel :

for further any query you can contact us

Ashutosh Kumar

9540923208

karnconsultant@gmail.com

No comments:

Post a Comment